The “Deadbeat Dad” Living Out of State: Your Legal Guide to Getting Child Support in Nevada

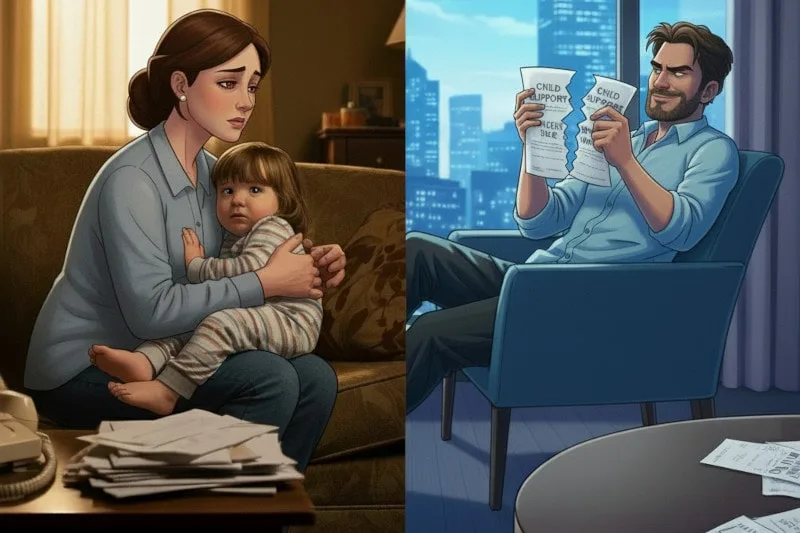

Every parent is committed to their child’s well-being, and that includes providing for them financially. But what happens when the other parent has moved out of state and is actively evading their child support obligation? The situation can feel impossible, especially if they are claiming to be unemployed or underemployed to avoid paying.

Fortunately, Nevada law and a powerful federal act are on your side.

Here’s a look at the legal tools and resources available to help you enforce your child support order, no matter where the “deadbeat dad” lives.

How The Uniform Interstate Family Support Act (UIFSA) Works

The first and most important tool in your arsenal is the Uniform Interstate Family Support Act, or UIFSA. This is a federal law that every state in the U.S. has adopted, and it was created specifically to solve the problem of parents fleeing to another state to avoid child support.

In simple terms, UIFSA creates a clear, legal path for you to enforce your Nevada child support order in another state.

Instead of you having to travel to the other state and navigate a foreign legal system, the Nevada court can work directly with the court in the other state to enforce the order. This means that once your Nevada order is registered in the other state, the other state’s court and enforcement agencies are legally required to treat it as if it were their own.

This process ensures that a parent’s duty to their children does not simply disappear by crossing state lines.

When They Claim No Income: The Power of “Imputed Income”

A common tactic used by an out-of-state “deadbeat dad” is to claim they have no income, work a low-paying job “under the table,” or are purposely unemployed to reduce or eliminate their child support payments.

But the law has a direct response to this: the concept of “imputed income.”

Imputed income is a legal term that essentially means a court can assign, or “impute,” an income to a parent for child support calculation purposes, even if they aren’t actually earning that money. This is done to prevent parents from purposely lowering their income to avoid their financial responsibility.

To determine how much to impute, a Nevada court will look at a number of factors, including:

- The parent’s past job history and earnings

- Their professional and educational background

- Their job skills and training

- Their assets and any other sources of income, like investments or inheritance

- The current job market in their location

- Whether their unemployment is voluntary or a result of an injury or disability

By considering these factors, a court can arrive at a fair and reasonable income amount and use that number to calculate a new child support obligation, holding the parent accountable for their potential earning capacity, not just their reported earnings.

What Happens When They Still Refuse to Pay?

The legal system doesn’t stop just because a parent refuses to comply. When a non-custodial parent (NCP) fails to pay, the consequences can be serious and far-reaching, even across state lines.

The court can hold a non-compliant parent in “contempt of court,” which means they have willfully disobeyed a legal order.

If this happens, the other state’s legal system, working with Nevada’s, has a number of powerful tools to enforce the order, which can include:

- License Suspensions

State agencies can suspend the parent’s driver’s license, professional licenses, or even hunting and fishing licenses until they comply. - Property Liens

A lien can be placed on their property, such as a house or car, preventing them from selling it until the back child support (or “arrears”) is paid. - Intercepting Funds

The federal government can intercept their federal tax refunds or lottery winnings and redirect the money to you for child support. - Criminal Charges & Arrest

In the most severe cases, if a parent willfully fails to pay for an extended period of time or owes a significant amount (e.g., more than a year or over $5,000), they can face criminal charges for non-support. This is a federal crime, and an arrest warrant can be issued. The parent could then be arrested in their new state of residence and face jail time, fines, or probation.

Getting Help: Government Agencies vs. A Private Attorney

When you’re ready to take the next step, you have two primary options:

- Child Support Enforcement (CSE) Program

This program is managed by Nevada’s Division of Welfare and Supportive Services (DWSS). The purpose of the program is to help parents establish, enforce, and collect child support orders, as well track down the non-complaint parent, enforce your existing order, and sometimes even help with modifying the support amount. Their services are often free or low-cost, which is a significant benefit.

However, because they are a public agency, they often have large caseloads, and your case may not receive the personalized attention or speed you need. - A Private Family Lawyer

Hiring a child support lawyer gives you a dedicated advocate who can focus solely on your case. A lawyer can often expedite the process and has the legal expertise to handle more complex situations, such as seeking subpoenas for bank records or other financial documents. They can fight aggressively to prove imputed income and make sure that every available legal tool is used to secure the support your child deserves.

Don’t Let Dead Beat Dads Get Off The Hook

Don’t let the distance or his excuses prevent you from getting the support you and your child are owed. You have legal options, and a team of experienced legal professionals can help you navigate this difficult process.

If you are a parent in Nevada trying to enforce an out-of-state child support order with your ex-husband, don’t hesitate to reach out to Smith Legal Group at 702-410-5001 to schedule your free consultation. We can help you understand your legal rights and options and develop a strategy to ensure your child’s financial future is protected.

Disclaimer: The information in this blog post is provided for general informational purposes only, and may not reflect the current law in your jurisdiction. No information contained in this blog post should be construed as legal advice. No reader of this post should act or refrain from acting on the basis of any information included in this blog post without seeking the appropriate legal or other professional advice on the particular facts and circumstances at issue.